Overlooked Opportunities

Issue 31 — January 4th 2026

Welcome back to The Long Term Edge.

Happy New Year. We are kicking off Issue 31 with a look at the road ahead.

The first trading week of 2026 gave us a familiar feeling: calm on the surface, but churning underneath. While the headline indices were red, the real story is the rotation happening below the surface. Between AI volatility, mixed signals from the labour market, and earnings season around the corner, the market is trying to decide where capital will flow this year.

Let’s dive in.

Market Overview (29th Dec to 2nd Jan)

U.S. equities finished the holiday-shortened week lower across major indices

The S&P 500 fell -1.1%, Nasdaq declined -1.6%, and the Dow closed -0.7%

AI-linked names dropped early in the week, while precious metals also struggled to find direction

FOMC minutes highlighted rising labour-market risk and diminishing inflation pressure

Initial jobless claims fell sharply below expectations, reinforcing labour-market resilience

Housing data remained firm, with prices continuing to edge higher

Week Ahead (Jan 5–9)

Here is what is on the radar as we start the first full week of the year:

Monday (The Tech Show): CES dominates the headlines. Expect a lot of noise about robotics, digital health, and mobility. Keep an eye on Nvidia, AMD, and Qualcomm. The keynotes here often set the narrative for tech in Q1.

Tuesday (The Consumer Check): Costco reports monthly sales. This is our best proxy for how the average consumer is actually feeling (and spending).

Wednesday (Staples & Energy): Earnings from Constellation Brands and Albertsons will tell us if companies still have pricing power.

Thursday (Retail Watch): We get updates from Tilray and Acuity, plus some data from European retailers that will shed light on global consumption.

Friday (The Big Number): The December Jobs Report. This is the main event. The expectation is for payroll growth to slow down significantly. The market wants a “soft landing”—slow enough to lower rates, but not so slow that it signals a recession.

Bottom line: This is a positioning week. Don’t chase the headlines coming out of CES; watch how the big money reacts to the labour data on Friday.

What’s In Store for Markets in 2026?

So, where are we heading?

The consensus is constructive but careful. Most smart money is looking for mid-single to low-double-digit returns. The days of “everything goes up” are likely paused; 2026 will be driven by earnings growth and real productivity, not just hype.

The Fed seems set to ease off the brakes, but don’t expect them to slam on the gas. Inflation is yesterday’s war. The new battlegrounds are labor stability, debt, and geopolitics.

Expect leadership to broaden. It won’t just be about AI infrastructure chips anymore. Look for the companies applying that tech, along with energy, defense, and automation plays.

Bitcoin & AI: The Cycle Shift

The biggest risk entering 2026 isn’t a recession. It’s misreading the cycle.

AI is not a speculative bubble; it is a productivity transition. It is being funded by massive corporate balance sheets, not just VC lottery tickets. Adoption will come in waves, and we are currently in a “prove it” phase.

Bitcoin fits a similar pattern.

If you’re worried about Bitcoin’s sideways action, zoom out. This consolidation reflects capital scarcity, not a broken thesis. For the last year, capital was allocated into AI, starving crypto of inflows. That dynamic won’t last forever.

Bitcoin is behaving less like a high-beta tech stock and more like long-term financial infrastructure. The fact that holders aren’t panic-selling during these dips signals maturity.

The “Ghost” Economy

We are entering a strange period where productivity increases without mass hiring. AI agents and automation are boosting margins, but that doesn’t show up in traditional labour data. This shift generally favours owning equities (the owners of the robots) over bonds.

AI reshapes how value is created.

Bitcoin reshapes how value is stored.

Uber: Autonomy as a Margin Opportunity

Few stocks are as misunderstood as Uber Technologies.

The prevailing fear is that autonomous vehicles will make Uber obsolete. In reality, autonomy threatens Uber’s cost structure, not its relevance.

Uber is not a transportation company. It is a global demand aggregation and routeing platform. Its value lies in pricing, payments, trust, safety, and scale, not vehicle ownership.

Autonomous vehicles reduce the largest cost input in the system: driver payouts. Even partial autonomy materially expands margins.

Uber’s strategy reflects this reality. Rather than building its own fleet, it positions itself as the neutral marketplace for autonomous supply, the interface everyone uses.

The market is pricing Uber as if:

distribution platforms become unnecessary

consumers adopt fragmented, single-provider apps

At current valuation levels, the stock reflects narrative risk, not business deterioration. That disconnect creates asymmetric upside for long-term investors.

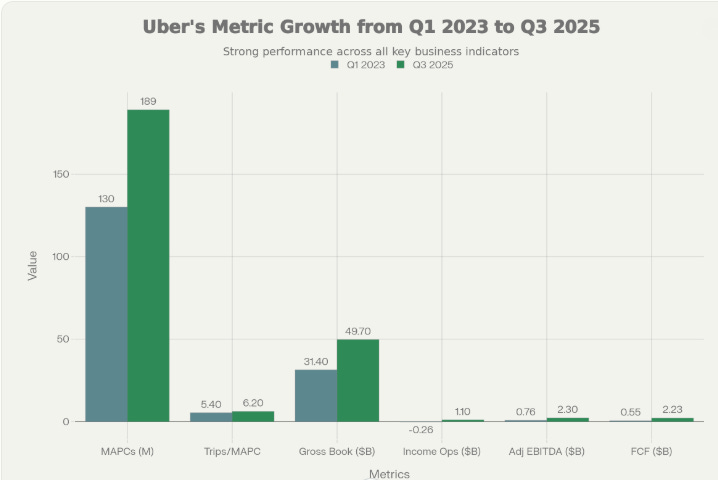

The chart above captures the most underappreciated part of Uber’s story: this business has already completed its hardest transition before autonomy arrives. From Q1 2023 to Q3 2025, Uber scaled monthly active platform consumers from 130 million to nearly 190 million, while increasing trips per user and expanding gross bookings materially.

More importantly, profitability has inflected. Income from operations flipped from a loss to positive, adjusted EBITDA more than tripled, and free cash flow expanded meaningfully. Uber is no longer subsidising growth; it is harvesting operating leverage across a global network that is already built and paid for. That matters because autonomy does not need to arrive to “save” Uber. It arrives to amplify an already profitable platform.

Seen through this lens, autonomy is not an existential risk but a margin lever. Even partial deployment in dense urban corridors, airports, or logistics routes lowers the cost per trip while demand remains intact. The chart reinforces this setup visually: user growth and engagement are compounding at the same time margins are expanding.

Uber first proved scale, pricing power, and cash generation. Autonomy, when it becomes economically viable, layers on top of that foundation. Markets often price autonomy as disruption; this data shows it is far more likely to be incremental upside applied to a business that is already working.

Adobe in 2026: A Brief Note

The market continues to price Adobe as if generative AI eliminates professional creative software.

That assumption confuses creation with production.

Adobe coordinates workflows, revisions, approvals, compliance, and brand consistency, functions that grow more valuable as content volume explodes.

Adobe’s challenge is narrative, not execution. At current levels, the market is paying for doubt.

A deeper dive will follow.

Closing Thoughts

Markets are not broken, they are evolving.

Productivity is rising without hiring. AI adoption is broadening beyond infrastructure. Bitcoin is transitioning from speculation to system. And platforms with real operating leverage are quietly compounding beneath the surface.

Positioning will serve you better than predicting.

Clarity compounds. Stay long-term.

Disclaimer: This newsletter is for informational purposes only and is not financial advice. Always do your own research or consult a licensed advisor.