Chips, Power, and Policy.

Issue 20 # 19 October 2025.

Outperform the Crowd- One Long-term move at a time.

Welcome to Issue 20 of The Long Term Edge, your weekly guide to building wealth over 7+ years.

We recap a volatile week (October 13–17, 2025) defined by strong AI-driven earnings from TSMC and ASML, shifting power trends in data centers, and renewed trade-war headlines between the U.S. and China. While short-term uncertainty continues, the long-term opportunity in energy, semiconductors, and infrastructure remains clear.

Market Overview

Indices rebounded: S&P 500 +1.7%, Dow +1.6%, Nasdaq +2.1% as bank jitters faded and AI optimism returned.

Banks stabilized: Zions and Western Alliance concerns eased after JPMorgan and Wells Fargo delivered strong results, showing robust loan growth and rising deposits.

Fed outlook steadied: policymakers reaffirmed expectations for two rate cuts by year-end; markets price in roughly 50 bps total easing.

AI remains market engine: TSMC and ASML topped expectations, confirming semiconductors as the core of the 2025 bull cycle.

Trade tensions resurfaced: Trump’s tariff warnings on Chinese imports sparked volatility, though both sides hinted at continued talks.

Energy transition accelerates: AI data centre operators are building private power generation facilities, reshaping the global energy landscape.

Earnings Preview: ASML & TSMC ; Powering AI’s Next Phase

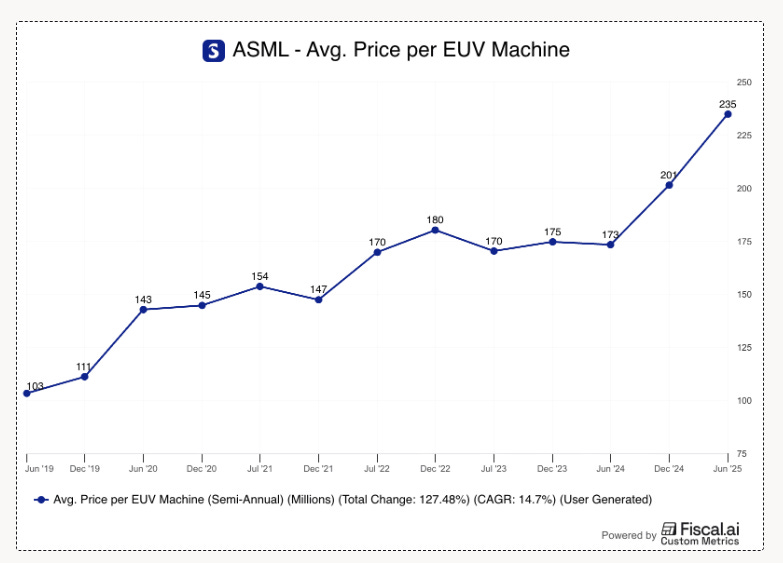

ASML and TSMC have both released strong Q3 earnings, reaffirming their roles as the backbone of AI’s semiconductor ecosystem. ASML reported revenue of $8.1 billion (–2.3% QoQ; +15% YoY) and net income of $2.27 billion (–8.5% QoQ), reflecting timing shifts in high-value EUV shipments as shown below. Gross margins stood at 51.6%, while bookings totalled $5.83 billion, with 67% linked to EUV tools used in sub-7nm logic production.

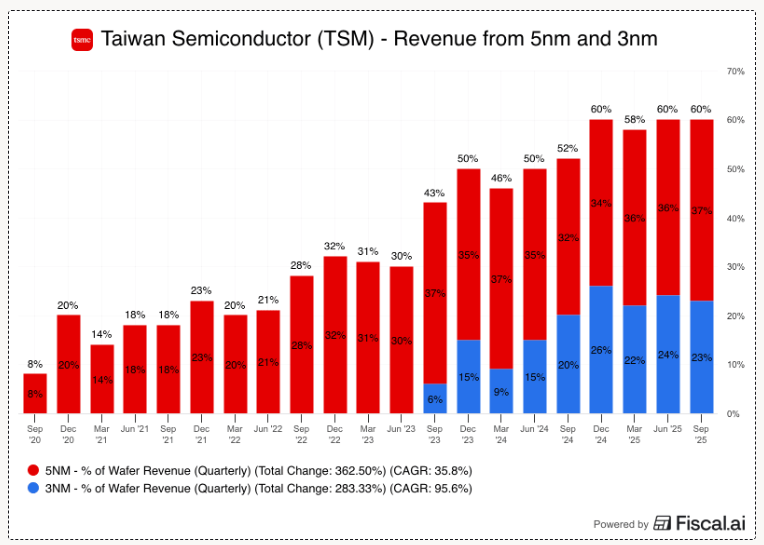

Meanwhile, TSMC outperformed expectations with $33.1 billion in revenue (+10.1% QoQ; +40.8% YoY) and $14.0 billion in net income (+13.6% QoQ). Its gross margin expanded to 59.5%, supported by AI and high-performance computing (HPC) chips, which now make up 57% of total revenue and 74% of wafers from advanced nodes — including 23% from 3nm production.

Post-earnings, ASML shares rose 8.8% on renewed EUV strength, while TSMC gained 5.2% following raised full-year guidance. Together, their results confirm that AI, not smartphones or PCs, is now the dominant structural driver of semiconductor growth.

What the Results Reveal About the AI Race

TSMC’s shift toward AI-dedicated wafers signals how deeply compute demand is reshaping the chip industry. Hyperscalers are booking capacity years ahead to secure GPU and ASIC supply, leading to packaging bottlenecks and escalating energy needs. TSMC executives described AI demand as “stronger than anticipated,” with rising orders from Nvidia, AMD, and Broadcom.

ASML’s €5.4 billion in Q3 bookings, two-thirds in EUV systems, underlines its monopoly position in enabling the next generation of AI processors. Its upcoming High-NA EUV tools (2026 rollout) will unlock 2nm and 1.4nm manufacturing, extending Moore’s Law into the next decade. Both firms flagged export-control risk, with ASML expecting a steep drop in 2026 China sales (down from 27% of H1 exposure), reinforcing the U.S.-centric reshoring trend dominating the semiconductor supply chain.

Collectively, these results illustrate that the AI race has shifted from algorithms to atoms, from software to the physical buildout of capacity, tools, and power. ASML and TSMC remain the twin pillars enabling that transformation.

Investment Implications

The numbers confirm that AI infrastructure is not hype, it’s capital expenditure. TSMC raised its CapEx to $40–42 billion, with 70% allocated to advanced nodes, while ASML maintained its €32.5 billion FY25 sales outlook (+15% YoY). These commitments anchor the next phase of AI investment, with hyperscaler spending projected to surpass $200 billion annually by 2028.

Capacity Expansion: TSMC’s $165 billion U.S. fab program (Arizona N2 plant) leverages CHIPS Act subsidies and diversifies geopolitical exposure.

High-Margin Moats: ASML’s 90%+ EUV market share and TSMC’s 90% advanced-node dominance sustain their pricing power and strategic indispensability.

AI Supply Chain Depth: 1GW data centers now contain ~$1.6 billion in TSMC silicon, driving a projected 40%+ CAGR in AI accelerators through 2029.

Risks: Tariff-related friction, overseas fab cost inflation (–1–2% margin effect), and energy constraints could limit near-term growth but do not threaten the structural trend.

For long-term investors, these are the “picks and shovels” of the AI supercycle; consistent free cash flow generators at the heart of every hyperscaler roadmap.

Outlook: 2025–2030

AI semiconductor growth is now entering a supercycle, with 20–30% annualised expansion projected through 2030.

Base Case: Node migrations (N2 in late 2025, A16 in 2027), High-NA EUV deployment, and vertically integrated packaging (CoWoS/SoIC) drive durable demand.

Moderate Case: If geopolitical or energy constraints persist, CAGR moderates to 15–20%.

Bull Case: Sovereign AI programmes, edge computing, and 3D chip architectures lift growth, creating a $4 trillion infrastructure market by decade-end.

ASML and TSMC are the foundation layer of AI compounding, irreplaceable, cash-generative, and structurally advantaged. They remain long-term buys in any market condition.

Macro & Policy: Trade Tensions and Bank Relief

Markets swung between U.S.–China trade headlines and bank earnings. Rare-earth export concerns briefly pressured tech names, but Beijing’s clarification calmed investors. Domestically, the Fed’s dovish tone offset regional bank volatility, with major lenders reporting $41 billion in combined Q3 profits (+19% YoY).

Jamie Dimon’s warning of “cockroaches in the credit markets” was met with calm, liquidity remains abundant, and deposit growth stable. Monetary easing and strong consumer data continue to anchor this late-cycle expansion.

Tech & AI: Circular Financing & Infrastructure Shift

The AI ecosystem is increasingly defined by circular capital flows. Big Tech invests billions into frontier labs like OpenAI and Anthropic, which then spend those funds on cloud and chip infrastructure from the same investors. Microsoft–OpenAI, Oracle–Stargate, Nvidia–OpenAI, and Amazon/Google–Anthropic exemplify this loop, inflating demand optics while masking underlying cash burn.

It’s functional but risky, reminiscent of late-cycle vendor financing from the dot-com era. Investors should favour low-debt enablers (ASML, TSMC) over heavily leveraged AI buyers. Expect heightened M&A and IPO activity as firms monetise hype into balance-sheet strength.

Energy & Infrastructure: AI’s “Bring Your Own Power” Era

AI compute is colliding with grid capacity. Projects like OpenAI and Oracle’s $500B Stargate complex in Texas, and CoreWeave’s privately powered data centers, show tech firms now building their own energy sources; gas turbines, solar arrays, even nuclear partnerships to secure a reliable supply.

This “BYO Power” movement could drive modernisation of U.S. grids but risks carbon lock-in if gas becomes the stopgap. Expect regulators to accelerate renewable integration and prioritise utility partnerships with hyperscalers.

Company Spotlight: Oracle

Oracle addressed concerns about its AI cloud margins, noting startup phases yield 14% gross margin, but mature contracts average 35%. Management lifted 2030 AI-server revenue targets to $166B (from $144B) and total company goals to $225B, driven by its $500B AI backlog, roughly $300B linked to OpenAI’s Stargate program. Execution remains key, but Oracle’s long-term positioning in AI infrastructure appears durable.

Macro Reflection: AI Rally vs. Trade Risk

Despite renewed tariff fears, the market continues to prioritise innovation over politics. The IMF’s global growth upgrade to 1.9% and Powell’s reassurance of continued rate cuts reinforced risk appetite. Bank stability, strong tech margins, and accelerating AI demand continue to outweigh short-term trade noise.

The Week Ahead

Earnings: Netflix, GE Aerospace, Coca-Cola (Tue); Tesla, IBM, AT&T (Wed); Intel, T-Mobile, Honeywell, Ford (Thu); Procter & Gamble (Fri).

Macro: CPI, PMIs, and consumer sentiment data return Friday after the shutdown delay.

Watch Tesla’s Robotaxi update (Wed 5:30 PM), Oracle’s Stargate financing updates, and any Fed commentary ahead of the Oct 28–29 meeting.

Action Plan

Stay focused on the builders of the AI economy while avoiding leveraged AI buyers reliant on circular financing. Use tariff- or macro-induced dips to scale into high-quality, cash-generative compounders. The decade ahead will reward those positioned in the physical infrastructure of intelligence, not the speculation surrounding it.

Clarity Compounds. Stay Long-Term.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Always do your own research or consult a licensed advisor.

This article comes at the perfect time, and I'm definetly wondering how these shifting power trends in data centers will impact the energy transition over the next decade, your insights are always so sharp!