AI’s Earnings Test

Issue 21 # 26 October 2025.

Outperform the Crowd- One Long-term move at a time.

Welcome to Issue 21 of The Long Term Edge, your weekly guide to building wealth over 7+ years.

Markets steadied ahead of the Mag 7’s reports as investors looked for proof that AI demand is translating into profits, not just promises. From Amazon’s outage resilience to Netflix’s tax-driven dip and the rise of orbital data centres, let’s delve into the latest in the financial market.

Market Overview

Indices advanced: S&P 500 +1.9%, Dow Jones +2.2%, Nasdaq +2.3%; led by tech and energy.

Rates eased: 10-Year Treasury yields fell 5 bps as inflation cooled.

Oil rebounded: WTI crude gained 2.4%, reversing last week’s pullback.

Earnings optimism: Softer CPI and strong early bank results lifted sentiment.

Sector winners: Tech (+3.5%) and Energy (+1.3%) outperformed; Consumer Staples fell (–0.5%).

Volatility: VIX closed the week at 16.37, its highest since August but still historically low.

Markets enter the most consequential stretch of earnings season, with the Magnificent 7 poised to define Q4 sentiment.

Earnings Preview: The Magnificent 7

The spotlight shifts to Microsoft, Meta, Alphabet, Amazon, Nvidia, and Apple, which collectively make up nearly 30% of the S&P 500’s market cap. Analysts expect aggregate revenue growth of 11% and EPS growth of 15%, driven by AI deployment and cloud resilience.

Microsoft (MSFT): Azure growth expected at 28–30% YoY with Copilot contributing significantly.

Meta (META): Revenue ~$39.8B (+20% YoY), EPS $5.60 (+16%); watch Reality Labs losses.

Alphabet (GOOGL): Cloud margins to expand ~1–2%; Gemini AI updates likely.

Amazon (AMZN): Revenue ~$163B (+13% YoY); AWS growth (~16%) slowed by last week’s outage.

Nvidia (NVDA): Guidance expected to reaffirm AI demand strength.

Apple (AAPL): Early sell-through data from Counterpoint Research show the iPhone 17 series outsold the iPhone 16 by 14% in the U.S. and China during the first 10 days of availability. In China, the base iPhone 17 nearly doubled its predecessor’s performance. The stock hit a new all-time high above $264 last week; a sign that Apple’s core hardware cycle may still have runway despite AI headwinds.

Investor takeaway: AI remains the earnings engine for the Mag 7. Investors will reward clarity on profitability and power efficiency.

Macro & Policy: Trade Calm, Fed Patience

Trade tensions eased as Washington and Beijing reopened tariff negotiations. The dollar softened after Fed comments reaffirmed a “data-dependent” path to gradual rate cuts. The IMF raised its 2025 global GDP growth forecast to 2.1%, citing U.S. resilience and Europe’s modest recovery.

Fiscal risks persist, but inflation trends continue lower, supporting soft-landing expectations. For now, the Fed’s challenge is not inflation but managing investor expectations.

Tech & AI: From Cloud Outages to Orbital Ambitions

The AI race expanded both above and below the cloud.

Amazon’s AWS outage on Wednesday disrupted Netflix, Venmo, and Slack for several hours; a sharp reminder of the world’s dependence on just a few cloud providers.

Google DeepMind unveiled its next-gen Gemini model, embedding AI deeper into YouTube and Android.

Meta merged its FAIR and GenAI units to speed up model deployment.

Starcloud Technologies announced plans for orbital data centres powered by solar energy and cooled in the vacuum of space. This is an audacious plan to bypass Earth’s energy and land constraints. Its first launch in late 2025 will deploy NVIDIA H100 GPUs for space-based inference, highlighting how compute infrastructure is moving off-world to sustain AI’s growth.

As compute demand skyrockets, power has become the real bottleneck.

Energy & Infrastructure: The Power Behind AI

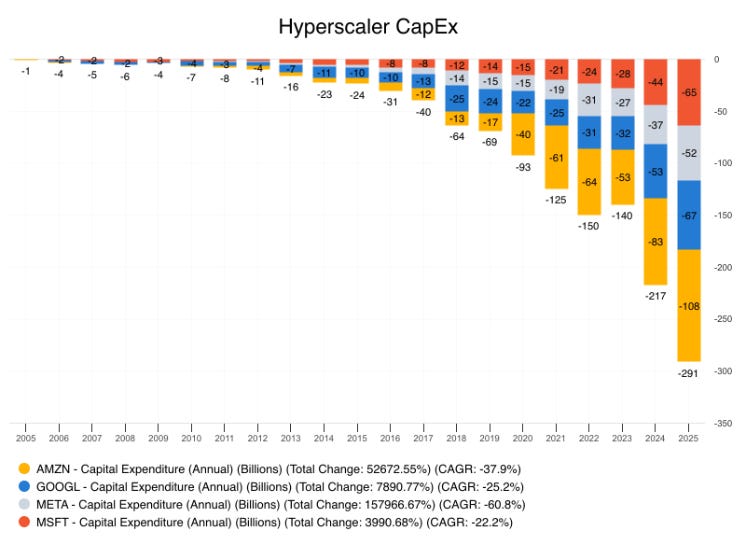

Data centers are now the fastest-growing source of U.S. electricity demand, projected to consume 3% of national output by 2030, up from 1% in 2024. Global expansion adds roughly 10 GW of new demand per year, with hyperscalers leading the charge. Amazon, Meta, Alphabet, and Microsoft have spent close to $300 billion in total expenditures over the last year alone creating a huge energy need.

NextEra (NEE) and Vistra (VST) are ramping up renewables and storage tied to hyperscaler contracts.

Eaton (ETN), Caterpillar (CAT), and Schneider Electric (SBGSY) benefit from rising hardware demand in the form of transformers, backup turbines, and switchgear.

Oracle’s Stargate project alone could require 10 GW; about New York City’s entire electricity draw.

Microsoft and Google, earlier secured nuclear and geothermal PPAs with Constellation Energy (CEG), SLB, and Ormat Technologies (ORA). This is evidence that Big Tech is locking in firm, long-term power for AI’s expansion.

The next phase of AI growth will be an energy story as much as a tech one. As grids strain, data centers are increasingly self-powering; whether leasing generation or building onsite capacity. Utilities and energy enablers are becoming quiet winners of the AI supercycle.

Company Spotlight: Netflix

Netflix delivered a solid Q3 revenue beat with $11.5 B (+17% YoY), but EPS of $5.87 fell short after a $619 M tax settlement in Brazil. The payout hit margins, trimming operating margin to ~28% (vs 31.5% guidance) and ending a six-quarter streak of EPS beats. Shares fell roughly 6% despite record subscriber additions.

The Brazil dispute rattled investors, but Netflix’s fundamentals remain intact. Its global ad-tier expansion, disciplined content spend, and new gaming verticals all signal sustainable growth. Long-term, Netflix continues evolving from a streaming platform to a global data-driven entertainment ecosystem where AI shapes production, recommendations, and even marketing strategy.

Company Spotlight: Amazon

Amazon’s Q3 preview underscored its scale and resilience. The AWS outage, which briefly disrupted Netflix, Shopify, and Venmo, highlighted the fragility of centralized cloud infrastructure. Yet, investor reaction told a different story: Amazon’s shares climbed as markets recognized that AWS is only one piece of a far larger, diversified empire.

Beyond AWS, Amazon’s business spans e-commerce, logistics, subscriptions, advertising, devices, and media. AWS remains the profit powerhouse, but advertising and logistics are expanding even faster.

Amazon thesis for dominance

Ecosystem Moat: Prime membership, logistics network, and one-day delivery create high switching costs.

Margin Leverage: AWS and advertising drive earnings compounding.

AI Integration: Generative AI tools for sellers and customers enhance monetization.

Energy Efficiency: Amazon is investing in renewable-powered campuses and warehouse automation to reduce cost and carbon intensity.

Other bets: Drones, robotics, and Project Kuiper (satellite internet) add upside beyond retail.

While outages grab headlines, they don’t shake Amazon’s foundation. The company’s breadth, infrastructure ownership, and relentless efficiency make it one of the few firms built to dominate both digital and physical economies over the next decade.

Week Ahead

Earnings: Microsoft (Tue), Alphabet (Tue), Meta (Wed), Amazon (Thu), Apple (Thu), Intel (Thu), Chevron & ExxonMobil (Fri).

Economic Data: U.S. Q3 GDP (Thu), PCE inflation (Fri).

Events: Japan CPI (Fri).

My plan

Watch Mag 7 guidance on AI spending, hyperscaler power partnerships, and utility commentary tied to data center growth.

I will add to my AMZ position on significant weakness.

MSFT doesn’t experience huge drawdowns, but I will look to to open MSFT long leap option call if it drops to around $500.

Clarity Compounds. Stay Long-Term.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Always do your own research or consult a licensed advisor.