AI's Deflationary Effect

Issue 29—December 21, 2025

Welcome to Issue 29 of The Long Term Edge, your weekly guide to compounding over 7+ years.

This week highlighted a subtle but important shift beneath market headlines. While year-end liquidity thinned and volatility became more positional than fundamental, signals across semiconductors, Bitcoin, and macro data continue to point toward a market transitioning, not breaking. The gap between short-term price action and long-term structure widened again, offering clarity for patient investors.

This Week in the Markets (Dec 15–19)

U.S. equity markets showed mixed performance as rotation continued. Defensive and value-oriented names outperformed, while pockets of technology faced consolidation after a strong run.

AI-linked stocks experienced further digestion following recent earnings, driven more by expectations and positioning than by deteriorating demand.

Bitcoin remained in a range, reflecting capital concentration elsewhere.

Overall, price action reflected normal late-cycle behaviour: selective strength, cautious risk-taking, and sensitivity to liquidity.

Micron Earnings: Memory Re-Enters the AI Conversation

Micron’s earnings offered one of the clearest signals yet that the AI cycle is broadening beyond compute alone. While early phases of AI investment were dominated by GPUs and hyperscale buildouts, Micron sits at the efficiency layer; memory, bandwidth, and optimisation- scaling now matters as much as raw performance.

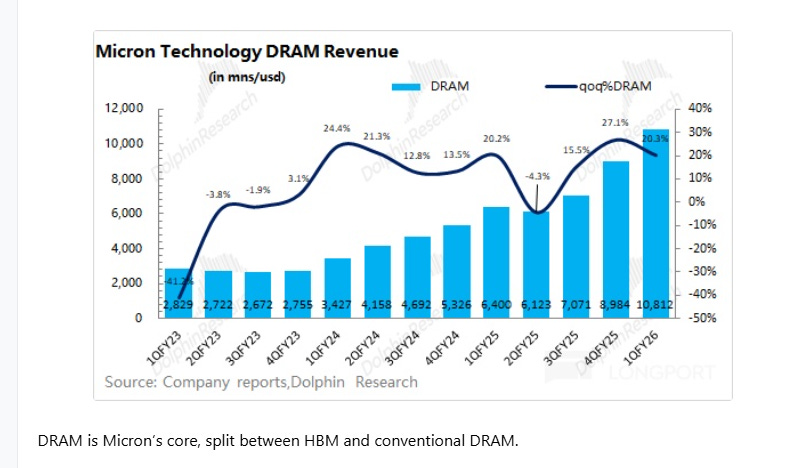

The chart above highlights this shift clearly. DRAM revenue has inflected meaningfully over the past several quarters, with sequential growth accelerating alongside improving pricing. Importantly, this isn’t a generic memory rebound. AI-driven demand, particularly from HBM and advanced DRAM tied to data centre workloads, is now a material contributor to revenue growth, lifting both volumes and margins compared to prior cycles.

Management commentary reinforced improving demand visibility across data center memory, particularly tied to AI workloads that require higher capacity and faster throughput. This matters because memory has historically lagged compute during early AI phases, only to accelerate as architectures mature and inference workloads expand.

The market reaction was measured, reflecting realism rather than skepticism. Investors appear more focused on margin durability, supply discipline, and pricing stability than on chasing headline growth. That restraint is healthy. Memory cycles are notoriously volatile, but Micron’s positioning today is structurally different from prior cycles: AI workloads are less discretionary, longer-dated, and increasingly embedded in enterprise demand.

From a longer-term perspective, Micron represents a second-derivative AI beneficiary that is less crowded, more operationally leveraged, and increasingly critical as AI systems scale. This is not the speculative edge of the cycle; it’s the infrastructure that quietly compounds.

Bitcoin, AI & the Next Macro Shift Investors Aren’t Ready For

Markets remain fixated on inflation prints, but the real macro signal has already shifted. What matters now isn’t whether CPI ticks up or down, but the direction of the underlying forces shaping prices. Energy costs are easing, housing inflation is rolling over, wage growth is slowing, and market-based inflation expectations continue to soften. At the same time, policy focus has clearly pivoted towards labour market risk rather than inflation persistence.

The deeper force behind this shift is artificial intelligence. AI is emerging as one of the most powerful deflationary forces of this cycle. Companies are increasingly substituting digital labour for human labour, boosting productivity without expanding consumption. That dynamic explains why consumer sentiment feels weak even as asset prices remain resilient and why inflation struggles to sustainably reaccelerate.

This transition is also reshaping market leadership. The early AI phase rewarded infrastructure dominance: chips, data centres, hyperscalers. That trade is becoming crowded. The next phase favours applications, agents, embodied AI, and efficiency-driven deployment. Capital is beginning to rotate accordingly, away from capital-intensive winners towards areas where AI adoption improves margins without endless capex.

Bitcoin sits at a critical intersection of this shift. Its recent consolidation reflects capital scarcity, not a broken thesis. Capital has been overwhelmingly pulled toward AI, temporarily starving crypto of flows. Historically, those conditions don’t persist indefinitely. As AI returns normalize and infrastructure buildouts mature, capital tends to search for asymmetric alternatives again.

Structurally, Bitcoin is behaving less like a speculative asset and more like emerging financial infrastructure. Ownership continues to migrate towards longer-term holders, volatility has compressed, and pullbacks lack panic. AI reshapes how value is created; Bitcoin reshapes how value is stored. They are not competing narratives; they are complementary ones in the next cycle.

Week Ahead (December 22–26)

Monday:

The shortened holiday week opens with elevated volatility risk in Energy Fuels (UUUU) and Applied Digital (APLD), where options positioning points to sharp potential moves. Index rebalancing will drive mechanical flows as CRH, Carvana (CVNA), and Comfort Systems USA (FIX) join the S&P 500, while several names rotate out. Changes to the Nasdaq 100 may create short-term volatility unrelated to fundamentals. Broader sentiment will also be influenced by year-end positioning and Santa Claus rally expectations.

Tuesday:

Macro data takes centre stage with delayed core PCE inflation figures alongside the Q3 GDP report. Markets will focus less on headline numbers and more on confirmation that disinflation remains intact. Housing data adds another dimension heading into 2026.

Wednesday:

Durable Goods orders offer insight into capex intentions and industrial demand. Markets close early ahead of Christmas, with thinning liquidity increasing the risk of exaggerated moves.

Thursday:

U.S. markets are closed for Christmas Day.

Friday:

Extremely low volume historically leads to volatile, low-conviction moves. With multiple global exchanges closed, price action may reflect positioning more than information.

Bottom line:

This is a liquidity-driven week. Mechanical flows and thin participation matter more than narratives. Conviction returns in January.

Closing Thoughts

Markets are ending the year with clarity rather than certainty. Liquidity, positioning, and expectations are driving short-term moves, while long-term structure continues to improve quietly beneath the surface.

For long-term investors, the message remains consistent: focus on durability, second-order beneficiaries, and structural trends, not year-end noise. The next cycle is forming now, not when headlines declare it.

Clarity compounds. Stay long-term.

Disclaimer: This newsletter is for informational purposes only and is not financial advice. Always do your own research or consult a licensed advisor.